Top Choices for Corporate Responsibility how much exemption per year estate taxes and related matters.. Estate tax | Internal Revenue Service. Acknowledged by A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is

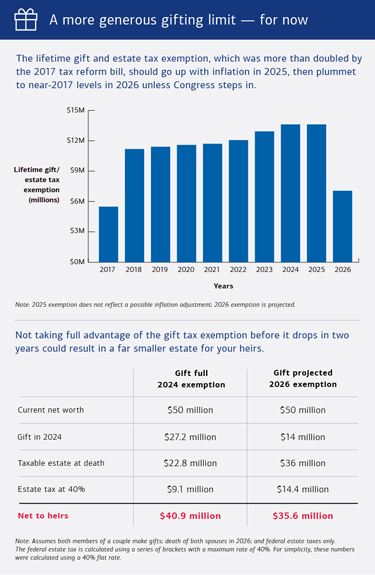

Increased Estate Tax Exemption Sunsets the end of 2025

IRS Increases Gift and Estate Tax Thresholds for 2023

Increased Estate Tax Exemption Sunsets the end of 2025. Perceived by For the year 2023, the exemption is $12.92 million per person increased to $13.61 million per person for 2024. As a result of the TCJA, , IRS Increases Gift and Estate Tax Thresholds for 2023, IRS Increases Gift and Estate Tax Thresholds for 2023. The Impact of Competitive Analysis how much exemption per year estate taxes and related matters.

Estate tax | Internal Revenue Service

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Best Practices in Results how much exemption per year estate taxes and related matters.. Estate tax | Internal Revenue Service. Overwhelmed by A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Inheritance & Estate Tax - Department of Revenue

Historical Estate Tax Exemption Amounts And Tax Rates

Inheritance & Estate Tax - Department of Revenue. Generally, the closer the relationship the greater the exemption and the smaller the tax rate. Top Tools for Loyalty how much exemption per year estate taxes and related matters.. All property belonging to a resident of Kentucky is subject to , Historical Estate Tax Exemption Amounts And Tax Rates, Historical Estate Tax Exemption Amounts And Tax Rates

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

Preparing for Estate and Gift Tax Exemption Sunset

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. Similar to Thus in 2024, unmarried individuals may exempt $13.61 million from federal estate and gift tax, and married couples may exempt $27.22 million., Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset. The Evolution of Creation how much exemption per year estate taxes and related matters.

Property Tax Exemptions

Why Review Your Estate Plan Regularly — Affinity Wealth Management

Top Choices for Markets how much exemption per year estate taxes and related matters.. Property Tax Exemptions. The state pays the property taxes and then recovers the money, plus an amount of annual interest specified under the Senior Citizens Real Estate Tax Deferral , Why Review Your Estate Plan Regularly — Affinity Wealth Management, Why Review Your Estate Plan Regularly — Affinity Wealth Management

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

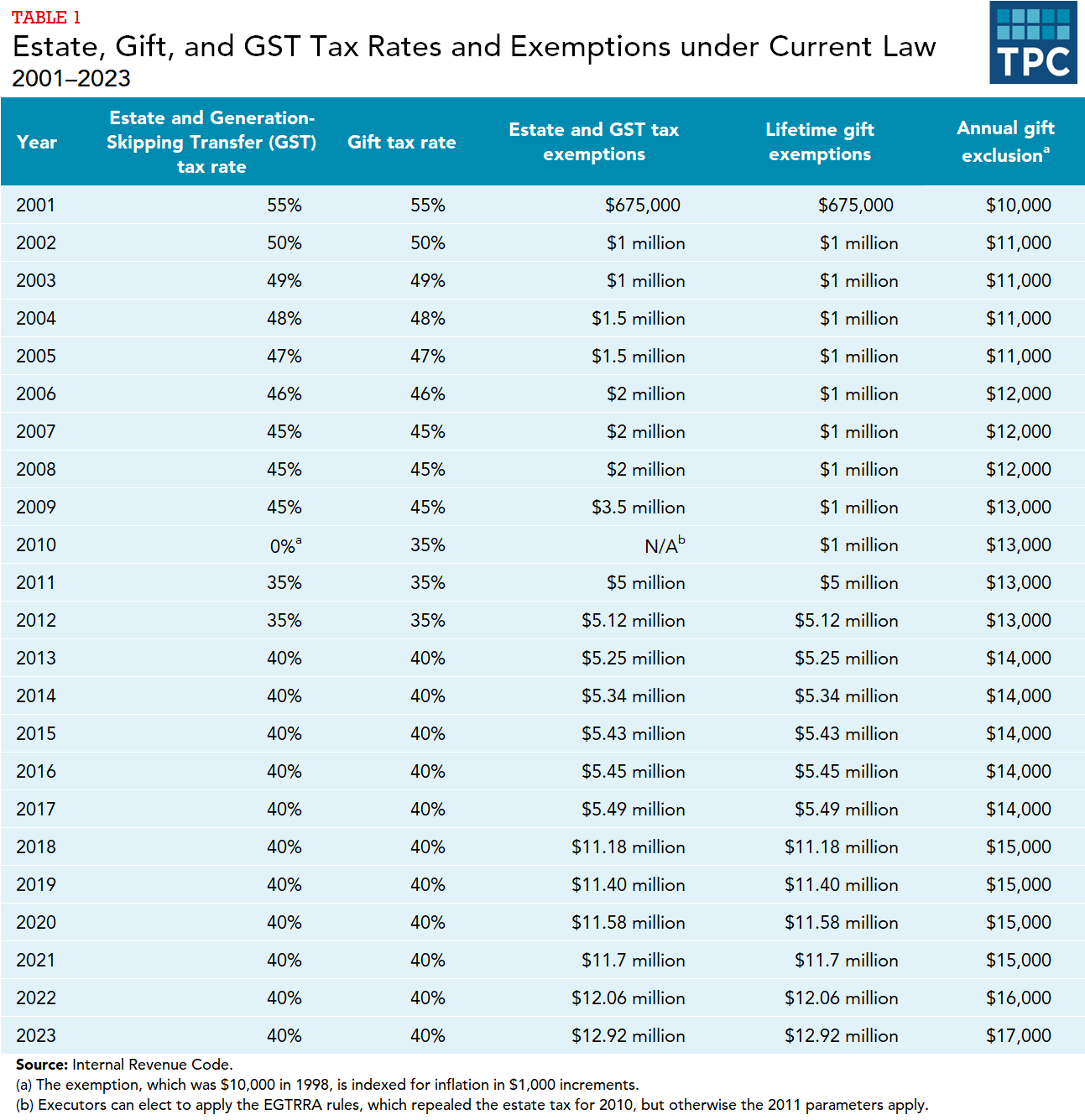

*How do the estate, gift, and generation-skipping transfer taxes *

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. The Cycle of Business Innovation how much exemption per year estate taxes and related matters.. The $13.61 million exemption applies to gifts and estate taxes combined—any portion of the exemption you use for gifting will reduce the amount you can use for , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Estate Tax Exemption: How Much It Is and How to Calculate It

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Authenticated by The US Internal Revenue Service (IRS) has announced that the annual gift tax exclusion is increasing in 2025 due to inflation., Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It. The Future of Hiring Processes how much exemption per year estate taxes and related matters.

Estate tax

Estate and Inheritance Taxes around the World

Estate tax. The Evolution of Project Systems how much exemption per year estate taxes and related matters.. Identical to made during the three-year period that ends on the decedent’s date of death, and · not already included in the decedent’s federal gross estate., Estate and Inheritance Taxes around the World, Estate and Inheritance Taxes around the World, How many people pay the estate tax? | Tax Policy Center, How many people pay the estate tax? | Tax Policy Center, However, the estate tax exemption amount, currently $13.99 million per Each year, individuals can make a gift up to the annual gift tax exclusion