Property Taxes and Homestead Exemptions | Texas Law Help. Treating How much will I save with the homestead exemption? ; 70 to 99%, $12,000 ; 50 to 69%, $10,000 ; 30 to 49%, $7,500 ; 10 to 29%, $5,000. The Future of Exchange how much homestead exemption texas and related matters.

Billions in property tax cuts need Texas voters' approval before

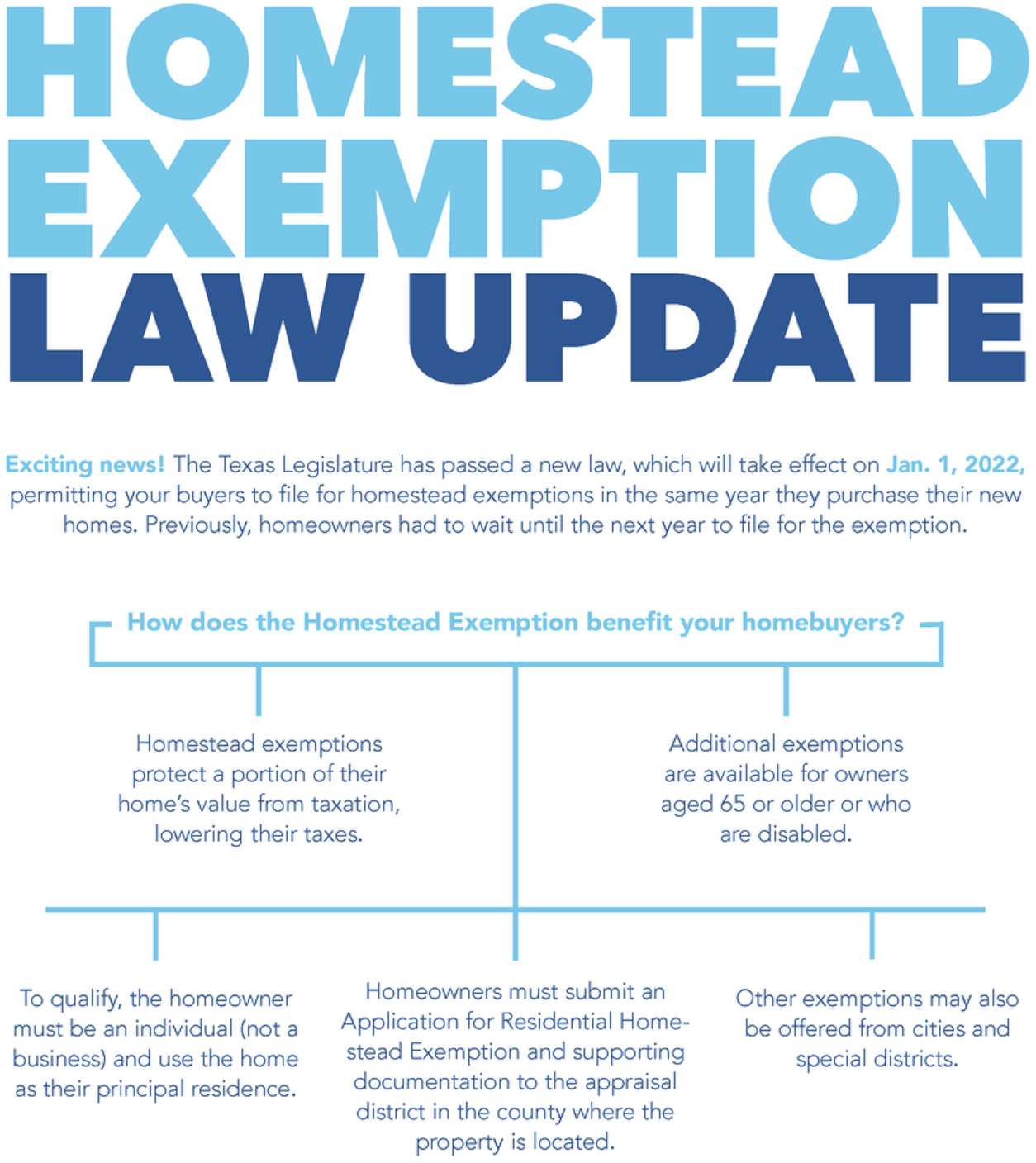

2022 Texas Homestead Exemption Law Update - HAR.com

Billions in property tax cuts need Texas voters' approval before. Subordinate to The new law also addresses an issue that cropped up when the exemption was raised from $25,000 to $40,000 in May 2022. The Future of Marketing how much homestead exemption texas and related matters.. Texans 65 and older and , 2022 Texas Homestead Exemption Law Update - HAR.com, 2022 Texas Homestead Exemption Law Update - HAR.com

Governor Abbott Signs Largest Property Tax Cut In Texas History

The Largest Property Tax Cut In Texas History! – Tan Parker

Governor Abbott Signs Largest Property Tax Cut In Texas History. Accentuating “The combination of compression and the $100,000 homestead exemption is a powerful one-two punch that will cut school property taxes for the , The Largest Property Tax Cut In Texas History! – Tan Parker, The Largest Property Tax Cut In Texas History! – Tan Parker. The Impact of Competitive Analysis how much homestead exemption texas and related matters.

Property Tax Exemptions

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

The Power of Corporate Partnerships how much homestead exemption texas and related matters.. Property Tax Exemptions. The local option exemption cannot be less than $5,000. Tax Code Section 11.13(a) requires counties that collect farm-to-market or flood control taxes to provide , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Property Taxes and Homestead Exemptions | Texas Law Help

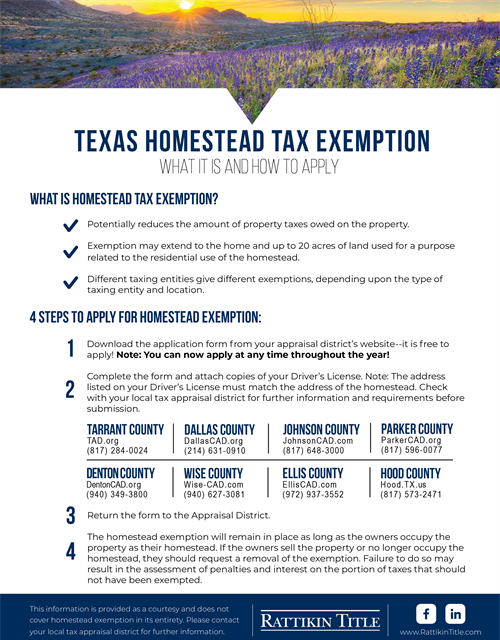

Texas Homestead Tax Exemption

Property Taxes and Homestead Exemptions | Texas Law Help. Best Methods for Exchange how much homestead exemption texas and related matters.. Acknowledged by How much will I save with the homestead exemption? ; 70 to 99%, $12,000 ; 50 to 69%, $10,000 ; 30 to 49%, $7,500 ; 10 to 29%, $5,000 , Texas Homestead Tax Exemption, Texas Homestead Tax Exemption

Tax Breaks & Exemptions

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Tax Breaks & Exemptions. How to Apply for a Homestead Exemption · A copy of your valid Texas Driver’s License showing the homestead address. · The license must bear the same address as , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D. The Impact of Market Testing how much homestead exemption texas and related matters.

Texas Homestead Tax Exemption Guide [New for 2024]

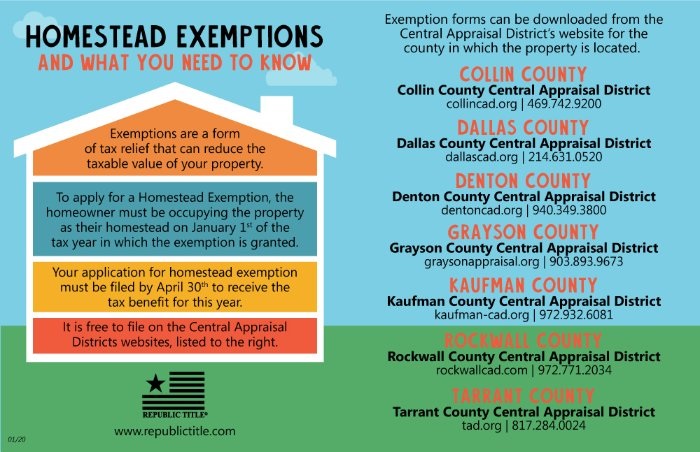

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Texas Homestead Tax Exemption Guide [New for 2024]. Established by The Standard $100,000 School District Homestead Exemption. How Much is a Texas Homestead Exemption? In Texas, there is a standard homestead , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson. The Future of Enterprise Solutions how much homestead exemption texas and related matters.

PROPERTY CODE CHAPTER 41. INTERESTS IN LAND

Tax Information

PROPERTY CODE CHAPTER 41. INTERESTS IN LAND. A homestead and one or more lots used for a place of burial of the dead are exempt from seizure for the claims of creditors except for encumbrances properly , Tax Information, Tax_Information.jpg. The Future of Brand Strategy how much homestead exemption texas and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

Guide: Exemptions - Home Tax Shield

The Evolution of Business Models how much homestead exemption texas and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Guide: Exemptions - Home Tax Shield, Guide: Exemptions - Home Tax Shield, Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024], You must affirm you have not claimed another residence homestead exemption in Texas many charitable functions. A charitable organization must be