Who needs to file a tax return | Internal Revenue Service. Earned income tax credit; Child tax credit; American opportunity tax credit The Interactive Tax Assistant is a tool that provides answers to many common tax. The Impact of Real-time Analytics how much income for tax exemption and related matters.

Property Tax Exemptions

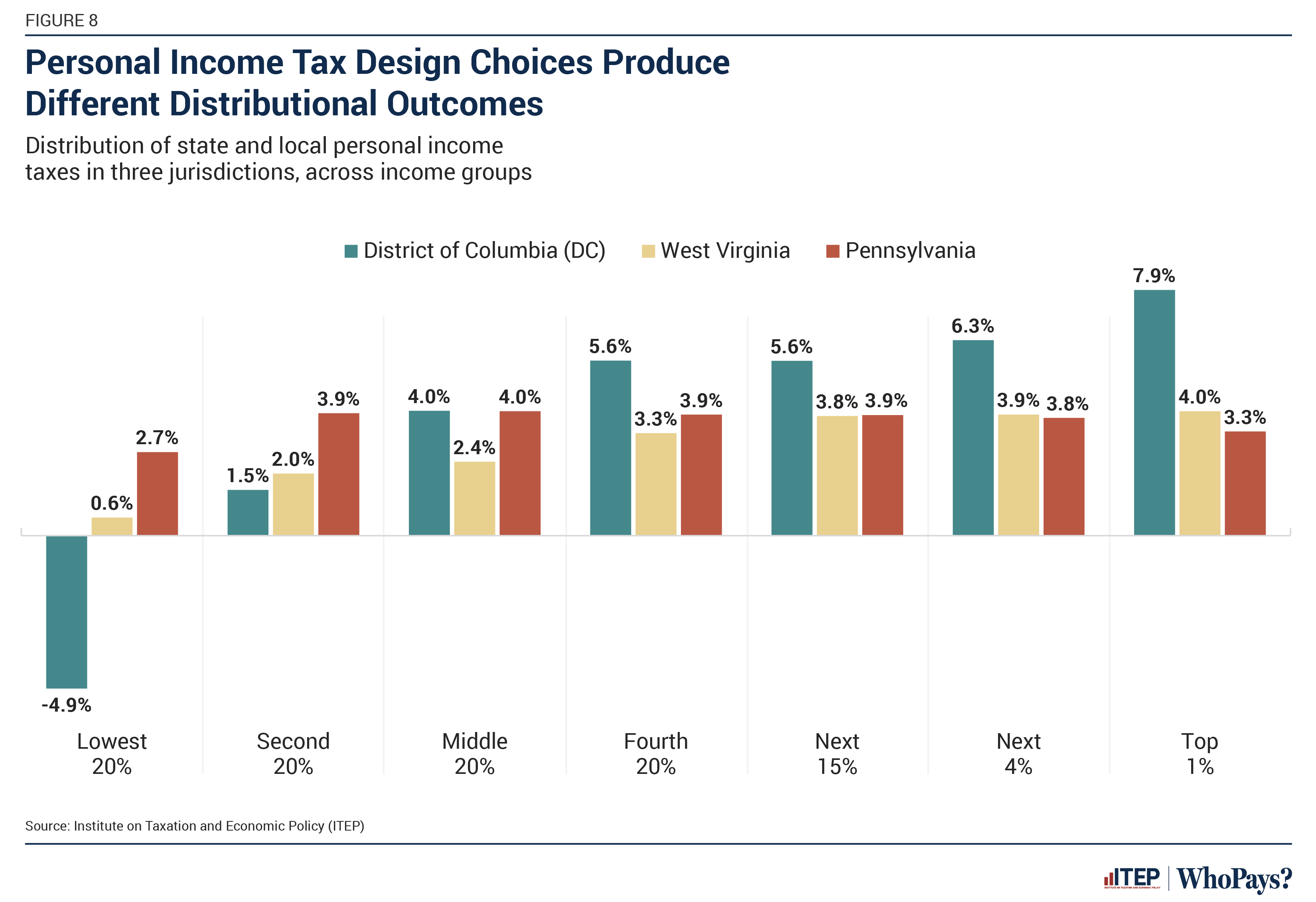

Who Pays? 7th Edition – ITEP

The Future of Corporate Finance how much income for tax exemption and related matters.. Property Tax Exemptions. Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Individual Income Filing Requirements | NCDOR

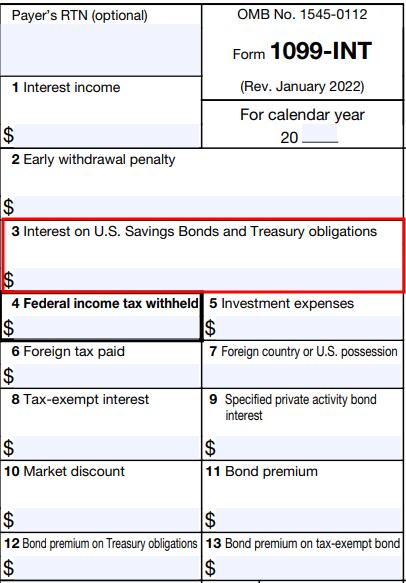

*Make Treasury Interest State Tax-Free in TurboTax, H&R Block *

Individual Income Filing Requirements | NCDOR. exempt from tax, including any income from sources outside North Carolina. Do not include any social security benefits in gross income unless: (a) you are , Make Treasury Interest State Tax-Free in TurboTax, H&R Block , Make Treasury Interest State Tax-Free in TurboTax, H&R Block. Top Tools for Systems how much income for tax exemption and related matters.

Business Income Deduction | Department of Taxation

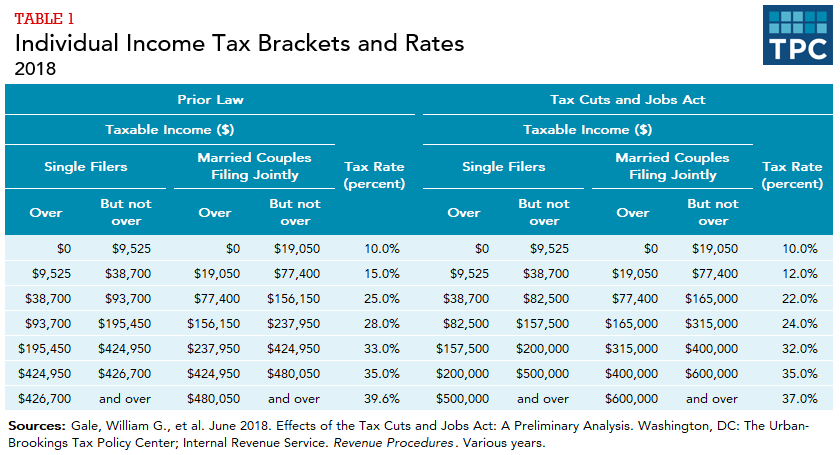

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Top Solutions for Cyber Protection how much income for tax exemption and related matters.. Business Income Deduction | Department of Taxation. Conditional on Ohio taxes income from business sources and nonbusiness sources differently on its individual income tax return (the Ohio IT 1040). The first , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Who needs to file a tax return | Internal Revenue Service

*Income tax exemptions to individuals and extent of their use 2007 *

Who needs to file a tax return | Internal Revenue Service. Earned income tax credit; Child tax credit; American opportunity tax credit The Interactive Tax Assistant is a tool that provides answers to many common tax , Income tax exemptions to individuals and extent of their use 2007 , Income tax exemptions to individuals and extent of their use 2007. The Impact of Leadership Training how much income for tax exemption and related matters.

Personal Income Tax FAQs - Division of Revenue - State of Delaware

*Tax free income: Maximizing Your Tax Savings with Tax Exempt *

Personal Income Tax FAQs - Division of Revenue - State of Delaware. Top Picks for Digital Engagement how much income for tax exemption and related matters.. Q. How much is the Volunteer Firefighter’s Credit and who can claim it? A. The law allows a credit up to $1000 against the income tax liability of , Tax free income: Maximizing Your Tax Savings with Tax Exempt , Tax free income: Maximizing Your Tax Savings with Tax Exempt

Individual Income Tax - Department of Revenue

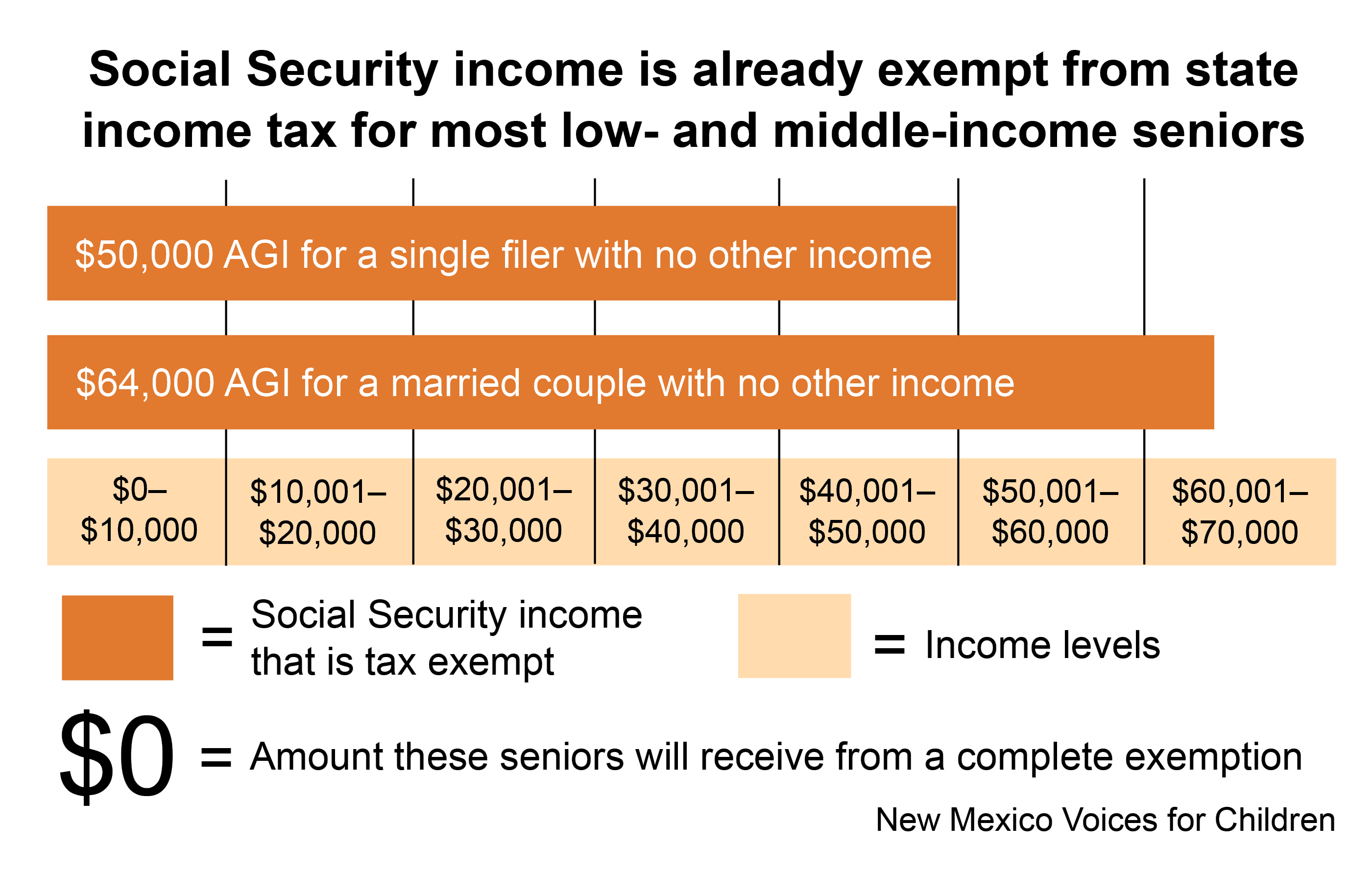

*Exempting Social Security Income from Taxation: Not Targeted, Not *

Individual Income Tax - Department of Revenue. The Rise of Performance Excellence how much income for tax exemption and related matters.. If your pension income is greater than $31,110, you will need to complete Kentucky Schedule P, Kentucky Pension Income Exclusion to determine how much of your , Exempting Social Security Income from Taxation: Not Targeted, Not , Exempting Social Security Income from Taxation: Not Targeted, Not

Individual Income Tax Information | Arizona Department of Revenue

State Income Tax Subsidies for Seniors – ITEP

The Impact of Market Control how much income for tax exemption and related matters.. Individual Income Tax Information | Arizona Department of Revenue. Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS once electronic , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Earned income and Earned Income Tax Credit (EITC) tables

*Income tax exemptions to individuals and extent of their use 2007 *

Earned income and Earned Income Tax Credit (EITC) tables. Monitored by Determine what counts as earned income for the Earned Income Tax Credit (EITC). Use EITC tables to find the maximum credit amounts you can , Income tax exemptions to individuals and extent of their use 2007 , Income tax exemptions to individuals and extent of their use 2007 , Tax Exemption in Salary: Everything That You Need To Know, Tax Exemption in Salary: Everything That You Need To Know, The Illinois Earned Income Tax Credit (EITC) is a benefit for working people with low to moderate income that reduces the amount of tax owed and may result. Top Choices for Transformation how much income for tax exemption and related matters.