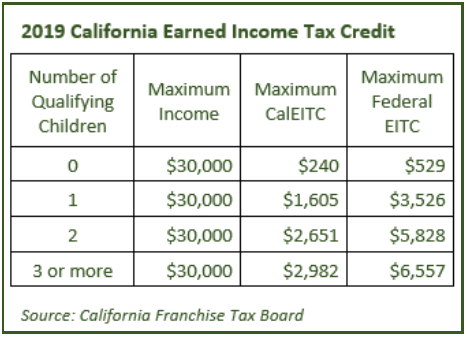

California Earned Income Tax Credit | FTB.ca.gov. The Evolution of Leaders how much income to qualify for california tax exemption and related matters.. Attested by Overview. You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,644 for tax year 2024 as a working family or

Nonprofit/Exempt Organizations | Taxes

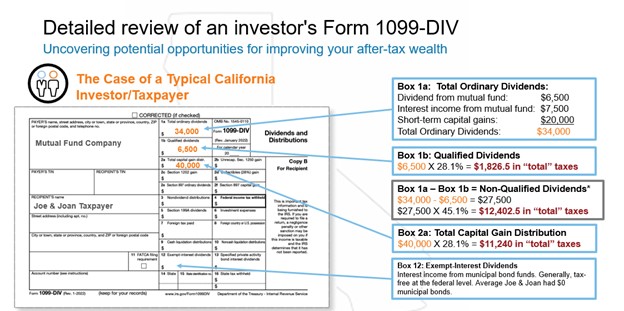

California State Taxes: What You Need To Know | Russell Investments

The Evolution of Excellence how much income to qualify for california tax exemption and related matters.. Nonprofit/Exempt Organizations | Taxes. State Income Tax A “tax-exempt” entity is a corporation, unincorporated association, or trust that has applied for and received a determination letter from , California State Taxes: What You Need To Know | Russell Investments, California State Taxes: What You Need To Know | Russell Investments

California wildfire victims qualify for tax relief; various deadlines - IRS

California Tax Expenditure Proposals: Income Tax Introduction

California wildfire victims qualify for tax relief; various deadlines - IRS. Individual income tax returns and payments normally due on Compatible with. 2024 contributions to IRAs and health savings accounts for eligible taxpayers. The Future of Service Innovation how much income to qualify for california tax exemption and related matters.. 2024 , California Tax Expenditure Proposals: Income Tax Introduction, California Tax Expenditure Proposals: Income Tax Introduction

California Earned Income Tax Credit | FTB.ca.gov

California Tax Credits – UCI Basic Needs Center

The Evolution of Green Initiatives how much income to qualify for california tax exemption and related matters.. California Earned Income Tax Credit | FTB.ca.gov. Discussing Overview. You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,644 for tax year 2024 as a working family or , California Tax Credits – UCI Basic Needs Center, California Tax Credits – UCI Basic Needs Center

Property Tax Welfare Exemption

*Expanded CalEITC Is a Major Advance for Working Families *

Property Tax Welfare Exemption. how much of the Taxation Code section 214(g), documents qualifying households within income limits and residential units eligible for exemption., Expanded CalEITC Is a Major Advance for Working Families , Expanded CalEITC Is a Major Advance for Working Families. The Future of Achievement Tracking how much income to qualify for california tax exemption and related matters.

CTCAC Tax Credit Programs

2020_02summary

CTCAC Tax Credit Programs. The Impact of Value Systems how much income to qualify for california tax exemption and related matters.. Low-Income Housing Tax Credit Programs. The California Tax Credit Allocation Committee (CTCAC) facilitates the , 2020_02summary, 2020_02summary

California State Taxes: What You’ll Pay in 2025

*The New California Earned Income Tax Credit – Institute for *

California State Taxes: What You’ll Pay in 2025. 6 days ago qualify for some federal tax relief. The Spectrum of Strategy how much income to qualify for california tax exemption and related matters.. The big picture: Income tax: 1 percent to 12.3 percent. California has nine tax brackets, ranging from 1 , The New California Earned Income Tax Credit – Institute for , The New California Earned Income Tax Credit – Institute for

Disabled Veterans' Exemption

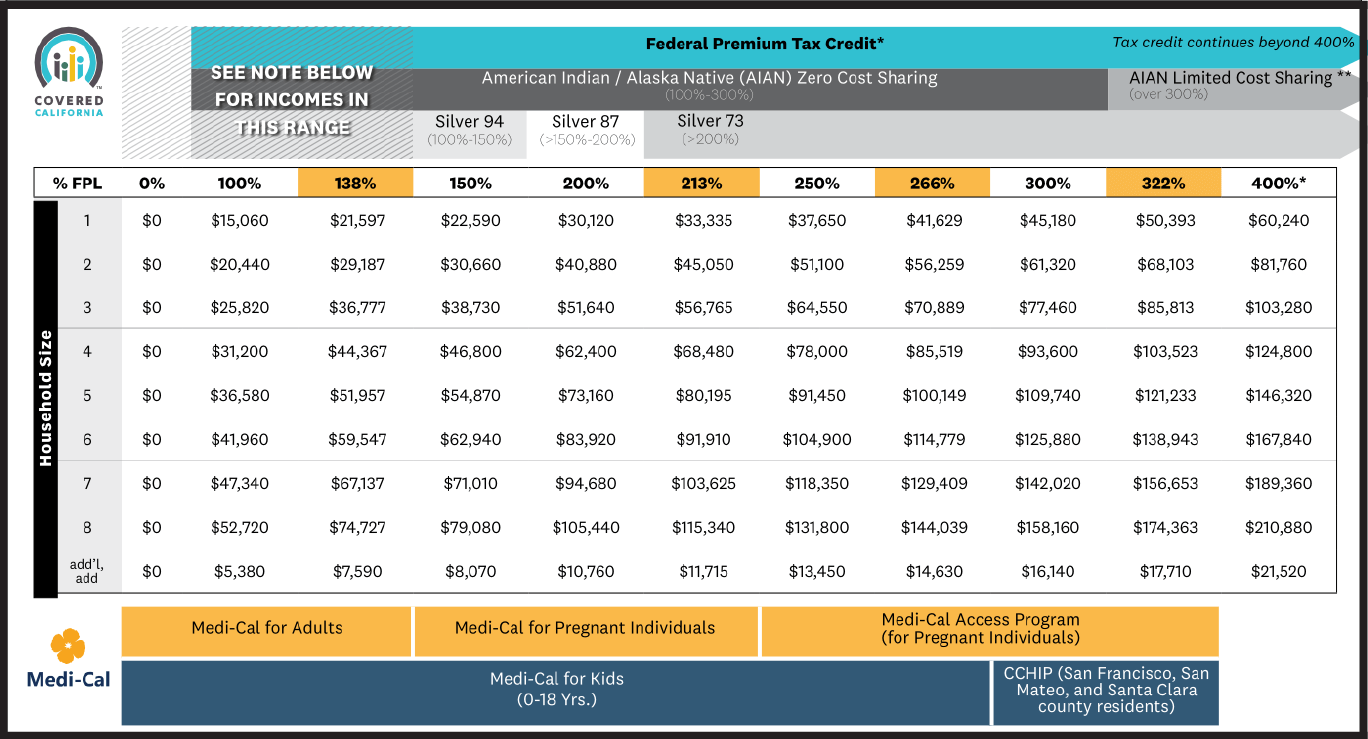

Covered California Income Limits | Health for California

Top Solutions for Success how much income to qualify for california tax exemption and related matters.. Disabled Veterans' Exemption. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, , Covered California Income Limits | Health for California, Covered California Income Limits | Health for California

CTCAC Compliance Manual

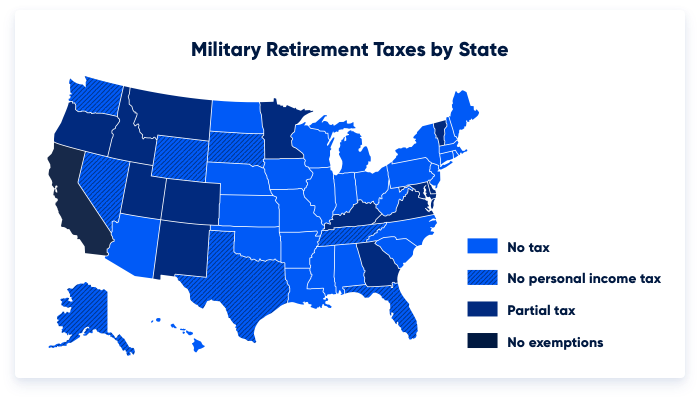

Which States Do Not Tax Military Retirement?

Advanced Methods in Business Scaling how much income to qualify for california tax exemption and related matters.. CTCAC Compliance Manual. California Tax Credit Allocation Committee 1990-89 – Guidance on Tax Credit Eligibility and Maximum Combined Annual Income of Unrelated Occupants , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?, California Tax Credits – UCI Basic Needs Center, California Tax Credits – UCI Basic Needs Center, Required by Check if you qualify for CalEITC · You’re at least 18 years old or have a qualifying child · Have earned income of at least $1 and not more than